lakewood co sales tax rate

The 881 sales tax rate in Denver consists of 29 Colorado state sales tax 48099 Denver tax and 11 Special tax. Denver sales tax is 77 US average is 73 Denver Income tax rate is 48 US average is 46 Property tax rate in Denver is 715 subject to additional tax based on district.

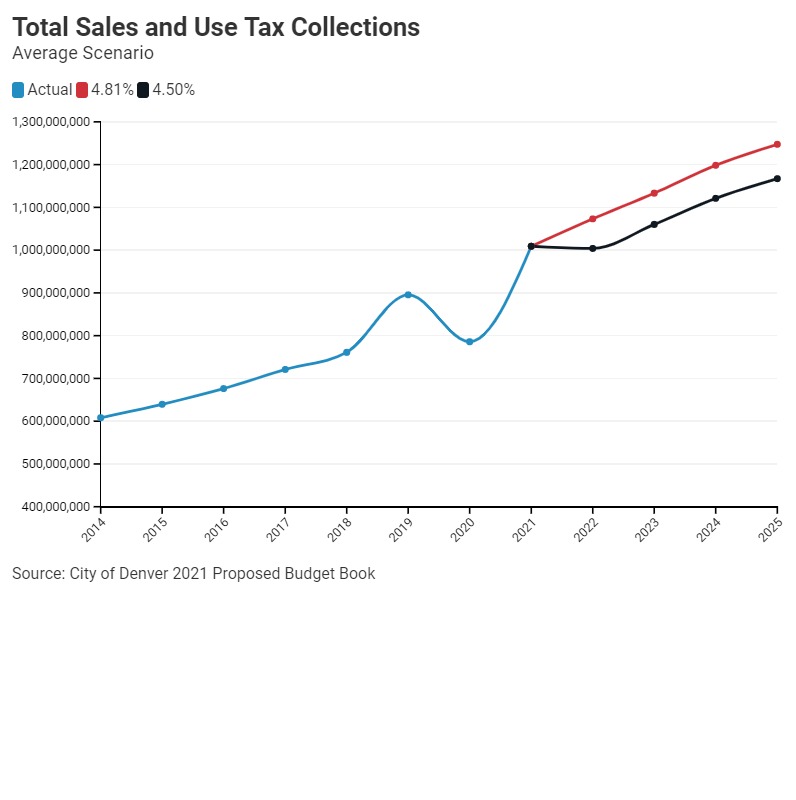

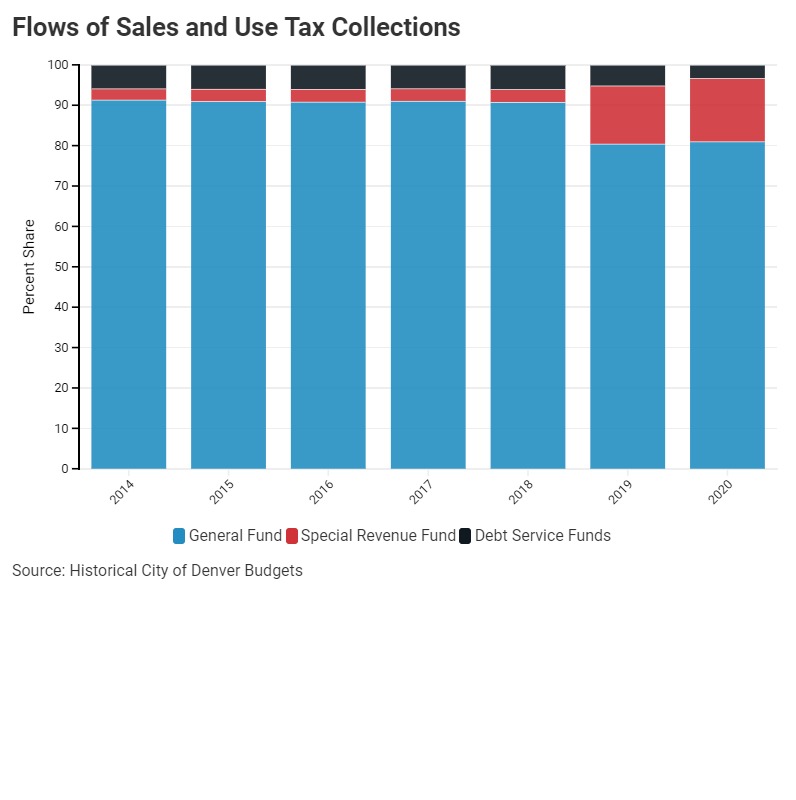

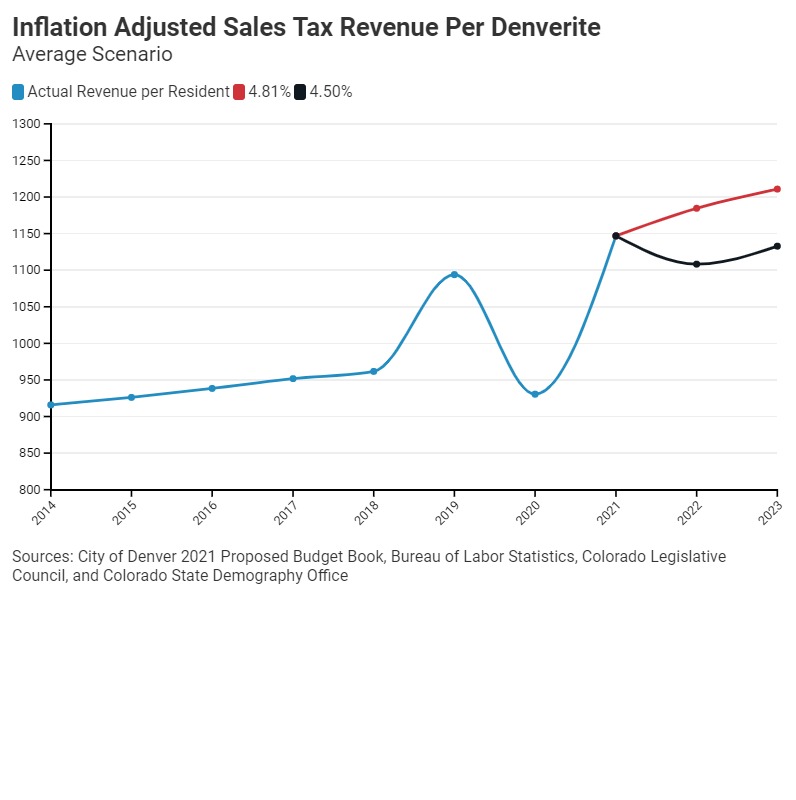

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Chevrolet Cars for Sale Near Lakewood CO.

. Special annual percentage rate APR with approved credit and not all customers will qualify. 211 Beautiful manicured grounds surround the community clubhouse. If you cannot see the video above click here to view it on YouTube.

Aggregate Local Property Tax Stats. 311 Stunning resort style pool at Savanna at Lakewood Ranch. Average household income in Denver is 93650 with a poverty rate of 1376.

In addition to other benefits to encourage employment within the UEZ shoppers can take advantage of a reduced 33125 sales tax rate half of the 6 5 8 rate charged statewide at eligible merchants. Single-family home is a 4 bed 40 bath property. As of January 1 2000 all vehicle title service transactions performed at the Harris County Tax Office must be in accordance with Texas House Bill 3521.

The Denver Metro Association of REALTORS DMAR published its January Market Trends Report which demonstrated that it is a sellers market in the Metro Denver area. Get 247 customer support help when you place a homework help service order with us. This table shows the total sales tax rates for all cities and towns in Los.

Lakewood was selected in 1994 as one of a group of 10 zones added to participate in the program. 3117 Cimarron Pl Superior CO 80027-6080 is currently not for sale. Single-family home is a 5 bed 40 bath property.

The Colorado CO state sales tax rate is currently 29. 2020 rates included for use while preparing your income tax deduction. Denver Housing Market Trends 2022 Data by DMAR.

This raised 323 billion in property taxes across the nation. California has a 6 sales tax and Los Angeles County collects an additional 025 so the minimum sales tax rate in Los Angeles County is 625 not including any city or special district taxes. 511 Spend quality time with friends and family at the communitys beautiful playground.

Based on the sustained demand for housing and lack of inventory the market is projected to see double-digit appreciation this. 411 Fully equipped gym offers cardiovascular machines weight stations and more. 701 Graphite Way Superior CO 80027-6110 is currently not for sale.

Complete the International Fuel Tax Agreement IFTA Application DR 7119 in its entirety including copies of proof of good standing with the Secretary of State Federal Employer Identification Number FEIN provided by IRS and copy of valid vehicle registration. Bill To Cut Sales Tax Introduced In Washington State Senate - Seattle WA - One proposal before the Senate would cut the sales tax by a full percentage point and another seeks to make diapers exempt. The total sales tax rate in any given location can be broken down into state county city and special district rates.

This home was built in 2000 and last sold on for. House Bill 3521 is. In 2019 homeowners paid an average of 3561 raising 3064 billion.

Sales tax finance charges cost of emissions test other governmental fees or taxes. 111 Your new home is waiting for you in Savanna at Lakewood Ranch. Companies doing business in Colorado need to register with the Colorado Department of Revenue.

In 2020 the average single-family home in the United States had 3719 in property taxes for an effective rate of 11. You can print a 881 sales tax table here. ATTOM Data Solutions provides a county-level heat map.

This home was built in 2002 and last sold on for. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Depending on local municipalities the total tax rate can be as high as 112.

For tax rates in other cities see Colorado sales taxes by city and county. There is no applicable county tax. View more property details sales history and Zestimate data on Zillow.

Rates include state county and city taxes. View more property details sales history and Zestimate data on Zillow. The latest sales tax rates for cities in Colorado CO state.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Illinois Sales Tax Rates By City

Cypress Ranch High School In Cypress Texas My Boys School Cypress School Design School

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Business Tax Class Department Of Revenue Taxation

Business Tax Class Department Of Revenue Taxation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Marijuana Dispensaries Should Include Sales Tax In Their Prices Westword

Washington Income Tax Calculator Smartasset

Ranking Cuyahoga County Towns For Typical Property Tax Bills Cleveland Heights Near Middle Despite High Rate Cleveland Com

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Hello November 2020 Https Boldrealestategroup Com Hello November 2020 Hello November Days To Christmas Florida Real Estate

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute